What Makes India the Next Big Bet for General Insurance

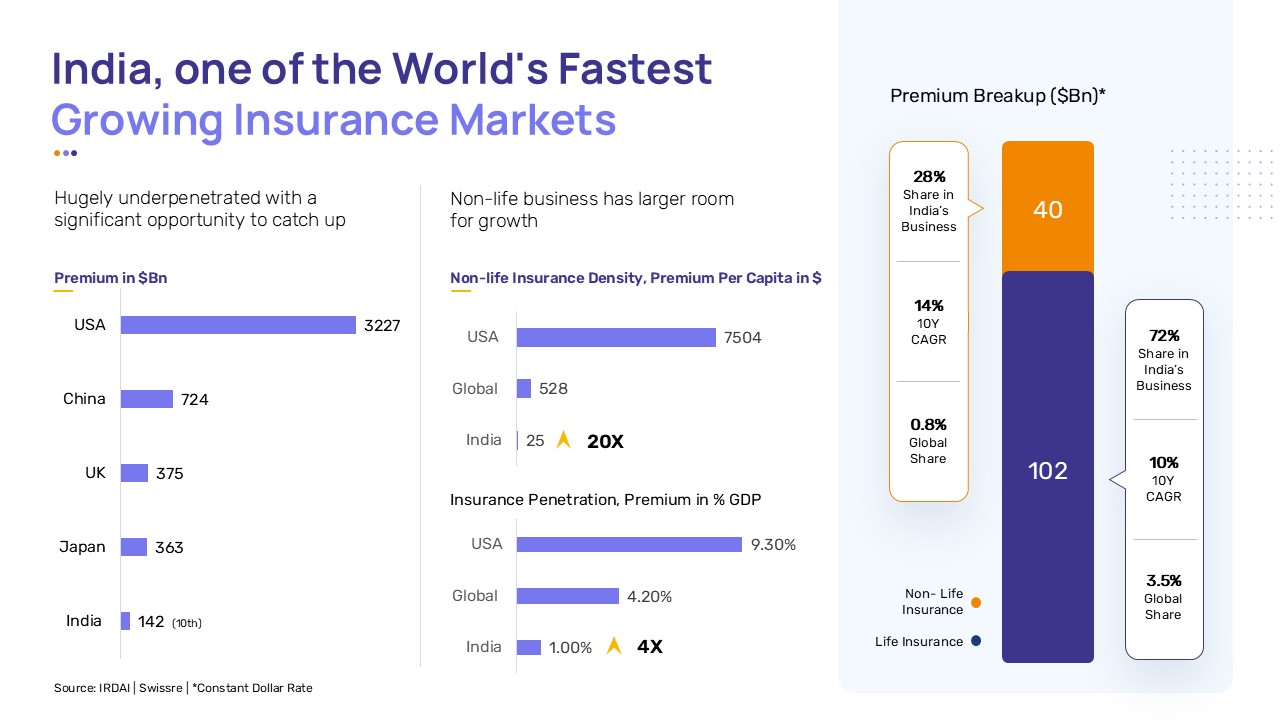

India’s general insurance sector is at the cusp of a defining transformation—one that mirrors the nation’s broader economic ascent. As the world’s fifth-largest economy and home to a rapidly digitizing consumer base, India presents a paradox of vast insurance potential and historically low penetration. With an annual premium volume of $142 billion, India remains vastly underinsured—its non-life insurance penetration at just 1% of GDP lags not just developed economies but also emerging peers like China (1.9%) and Brazil (1.7%). This under-penetration translates into a staggering health protection gap of 73%, exposing businesses and households to financial vulnerabilities.

However, as the nation strives toward its vision of “Insurance for All” by 2047, the convergence of regulatory reforms, rising incomes, and technological innovation sets the stage for explosive growth. With a burgeoning middle class and increasing awareness of financial protection, the next decade will not just see insurance expansion but its deeper integration into India’s financial fabric—empowering individuals, businesses, and industries alike.

A Dormant Giant Ready to Soar

India’s general insurance market offers an intriguing paradox: despite its scale, its metrics reflect immense room for growth. Insurance density in the country remains staggeringly low at $25 per capita for non-life insurance, compared to the global average of $528 . A large informal workforce, accounting for nearly 90% of total employment, further exacerbates the protection gap, as employer-sponsored coverage remains scarce. These numbers underscore a significant runway for expansion, with the potential for a 20x increase in market size.

This growth is underpinned by favorable demographics, including a young, tech-savvy population and a rising middle class. Additionally, government efforts to increase financial inclusion are accelerating the adoption of innovative, customer-first insurance solutions. As digital ecosystems expand, insurers are leveraging data-driven insights to deliver affordable, accessible, and tailored coverage. This is not just a market catching up—it is a dynamic ecosystem ready to lead.

A Dynamic Landscape in Transition

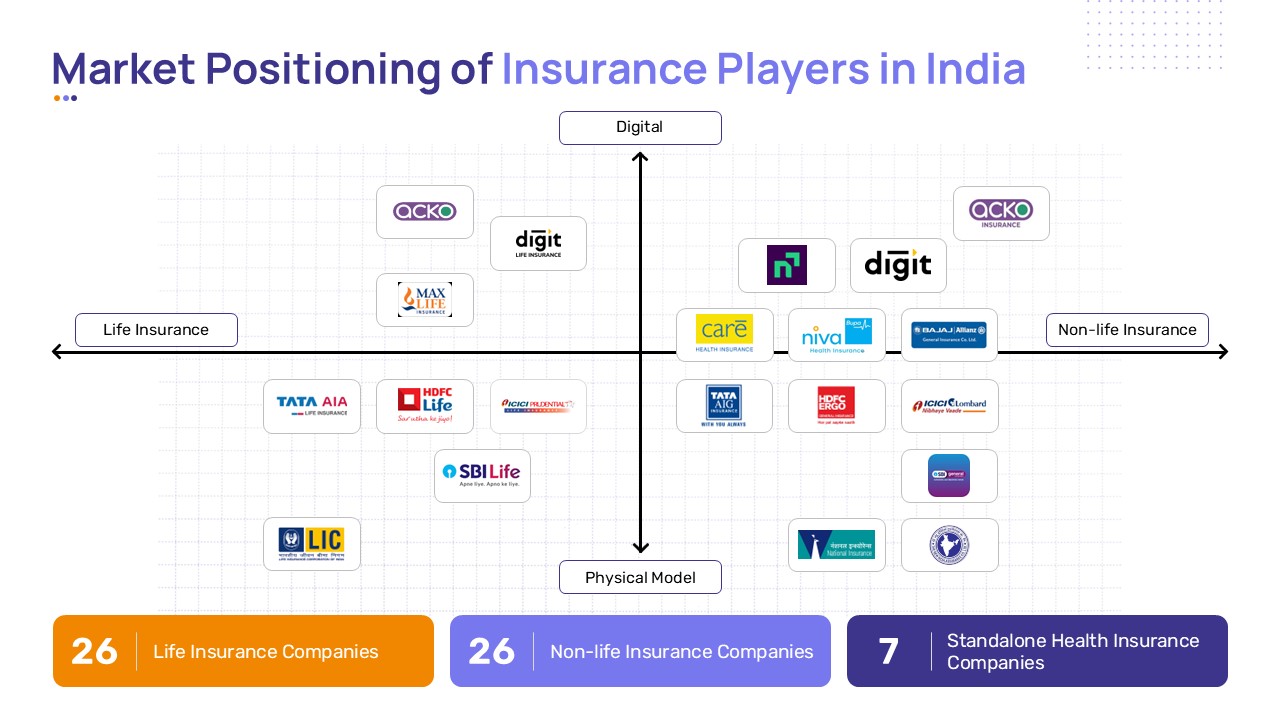

India’s insurance market is a compelling case study in balancing legacy strength with digital disruption. Traditional giants like LIC and Tata AIA rely on expansive physical networks to maintain consumer trust, but they are increasingly embracing hybrid models that integrate technology to meet rising demand for seamless experiences.

On the other hand, digital-first disruptors such as ACKO and Digit are redefining the market with lean operational models, advanced analytics, and hyper-personalized offerings. By directly engaging with tech-savvy consumers, these players have streamlined the customer journey, from onboarding to claims.

Standalone health insurers, including Niva Bupa and Care Health, are capitalizing on the growing demand for specialized products post-pandemic. With a focus on speed and simplicity, these insurers deliver tech-enabled solutions that resonate with a population increasingly aware of health risks. The coexistence of physical and digital models underscores the market’s evolution into a dual-force ecosystem, combining tradition with innovation.

Tailwinds Driving Industry Growth

India’s insurance sector is riding on robust regulatory and socio-economic tailwinds. Progressive reforms, such as the increase in FDI limits from 49% to 74%, have attracted global capital and enabled insurers to scale. Initiatives like the “Insurance for All by 2047” campaign underscore the government’s commitment to inclusive growth, while efforts to simplify policies and digitize processes have made insurance more accessible to diverse demographics.

At the same time, socio-economic factors are creating fertile ground for growth. Rising healthcare costs and climate change-related disasters have heightened risk awareness, accelerating insurance adoption. Meanwhile, an increasing number of digital transactions and asset ownership trends are driving demand for products like cyber, home, and travel insurance.

India’s economy is expected to reach $10 trillion by 2032, boosting disposable incomes and broadening the affordability of insurance products. With 65% of the population under the age of 35 and rapid digital penetration, the market is primed to attract new customers, particularly in underserved areas. Increasing risk awareness, driven by post-pandemic priorities, is further accelerating this shift.

General Insurance Leading the Next Growth Wave

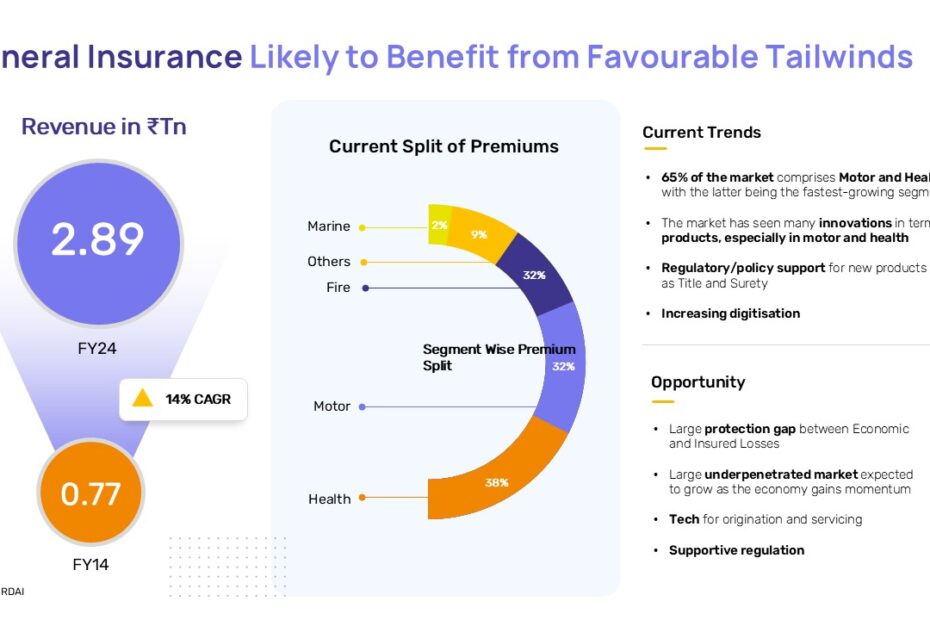

The general insurance sector in India is experiencing rapid growth, with revenues climbing from ₹0.77 trillion in FY14 to ₹2.89 trillion in FY24, reflecting a robust 14% CAGR. This growth is anchored by motor and health insurance, which together contribute 65% of the total market. Health insurance, in particular, has emerged as the fastest-growing segment, fueled by rising healthcare costs and innovative products.

Despite this momentum, the market’s vast under-penetration leaves a large protection gap between economic losses and insured coverage. This gap highlights a significant opportunity for insurers to scale, leveraging technology for efficient origination and servicing. Innovative product categories, such as Title and Surety insurance, along with digitization, are reshaping customer experiences and making insurance more inclusive. Supported by favorable regulations, India’s general insurance market is poised for exponential growth.

From Regulation to Customer Empowerment

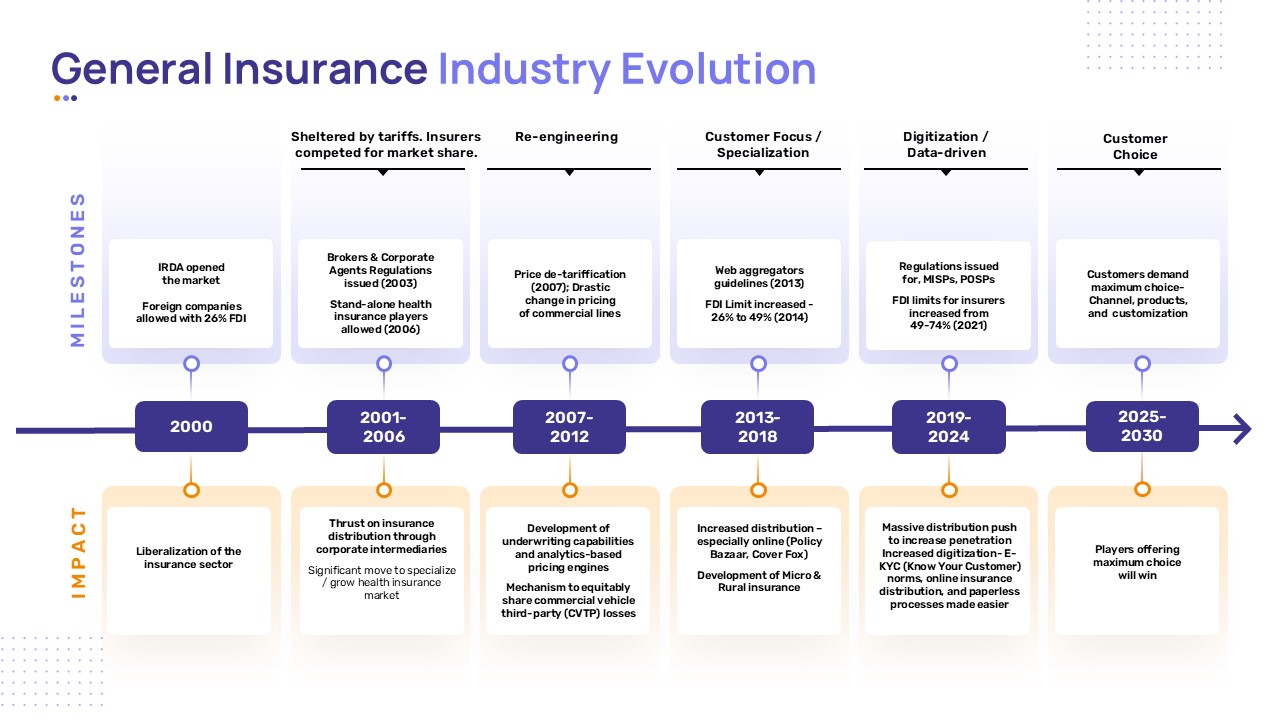

The evolution of India’s general insurance industry reflects a remarkable journey of adaptation and innovation. Beginning with the liberalization of the sector in 2000, when the IRDA allowed 26% FDI, the market opened to global players and healthy competition. This was followed by re-engineering efforts in the late 2000s, including the de-tariffing of commercial lines, which introduced analytical pricing and underwriting capabilities.

From 2013 onward, the rise of web aggregators like PolicyBazaar made insurance more accessible, while increased FDI limits accelerated the market’s growth. Today, digital tools like e-KYC, paperless onboarding, and multi-channel access are empowering customers with maximum choice and personalization. As we move toward 2030, the industry is increasingly customer-centric, balancing innovation with inclusion to redefine financial security.

The Road Ahead for Innovation and Inclusion

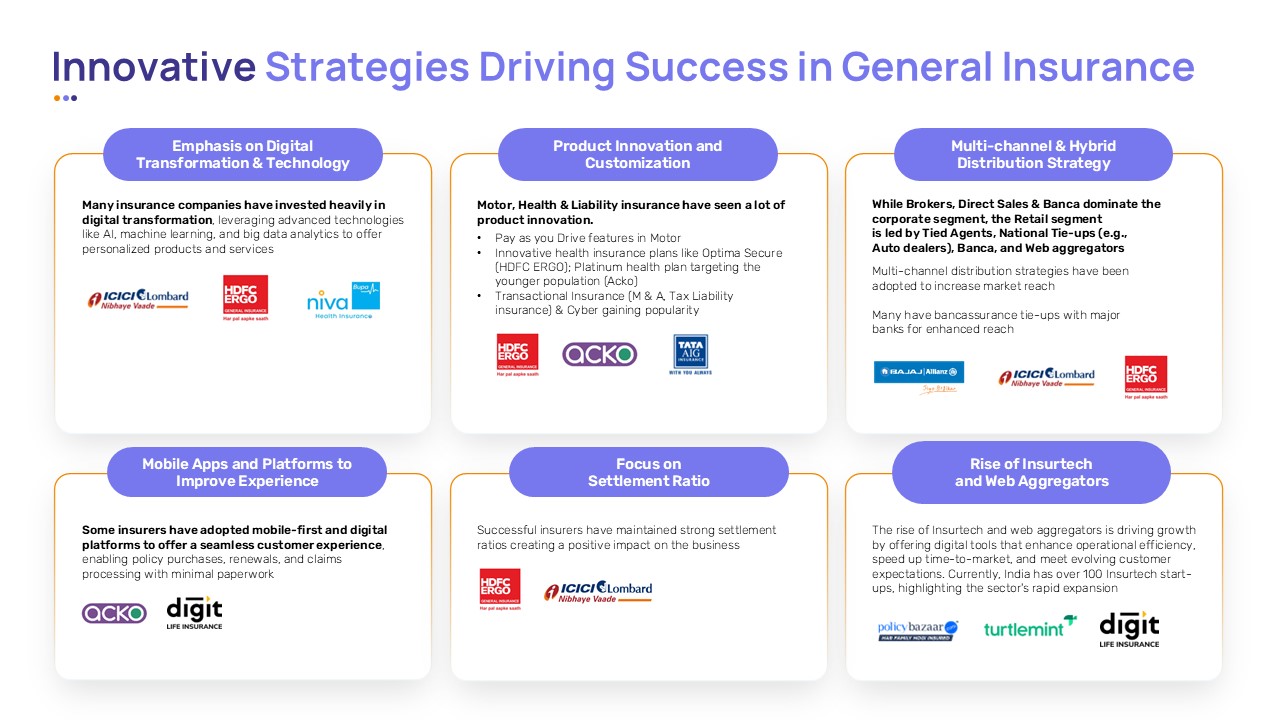

The general insurance sector is embracing transformative strategies that are redefining success. Insurers are heavily investing in AI, machine learning, and big data analytics to deliver personalized products and enhance operational efficiency. Digital-first players like Digit and InsurTech startups such as Turtlemint are driving innovation, while traditional players adopt hybrid approaches to retain their customer base.

Product innovation is another cornerstone. From “pay as you drive” motor insurance to niche offerings like cyber and transactional insurance, insurers are addressing diverse customer needs. Distribution models are also evolving, with brokers, tied agents, and online aggregators playing critical roles. Strategic bancassurance partnerships are further enhancing market reach.

Combined, these strategies are creating an agile and inclusive insurance ecosystem that balances scale with customer satisfaction. With over 100 InsurTech startups disrupting traditional paradigms, the industry is poised for a future defined by resilience, innovation, and growth.